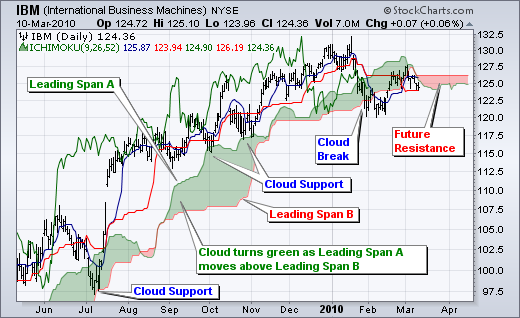

The Ichimoku Cloud is a technical indicator used to spot market trends. It is composed of two lines, the Leading Span A and the Trailing Span A. The Leading Span A is a moving average of the past 52 periods, and the Trailing Spec is a moving average of the previous 52 periods. The Ichimoku Cloud is similar to a simple moving average chart in that it filters out price fluctuations based on trend and momentum.

The Ichimoku Cloud is most effective in short time frames, as it produces less false signals. However, it is important to understand that the Ichimoku Cloud is not always a reliable indicator, and that you should use it in combination with other indicators to maximize your chances of success. The data points calculated from this indicator are based on historical data, and are projected into the future. The formula is not predictive, as it uses historical data and forecasts future price movements. Additionally, it is a lagging indicator, which means that the Ichimoku Cloud may give out late signals when markets reverse quickly. Therefore, it is recommended that you back up any signals generated by the Ichimoku Cloud with price action analysis to ensure you get the best results.

The Ichimoku Cloud indicator is a useful tool for trend-following. In order to use it correctly, you should use the Conversion and Base lines in conjunction with RSI divergences. The RSI divergence is an indicator that may indicate a reversal. This can also be used to determine whether the price has broken the Cloud. If a price has broken the Cloud, it could mean the end of a downtrend.

The Ichimoku Cloud indicator changes colour based on the movement of the Leading Span A. If the Leading Span A crosses over the Leading Span A, then the Ichimoku Cloud indicator is a bullish signal. Otherwise, if prices are moving within the cloud, then the market is neutral. The size of the cloud also matters when interpreting market weather. A narrower cloud implies a weak trend while a wider one indicates a strong trend. The Ichimoku Cloud is used for signal analysis.

The Ichimoku Cloud is often displayed in green or red. The Leading Span A line is the same color as the Leading Span B line, and is a bullish indicator. The Leading Span A line is the opposite, and is a bearish signal. The two sands are a bullish indicator. The Leading Stacks A and B are the same color. Similarly, the Leading Streams A and B will form a cloud when the Leading Strat A and B are equal.

The Ichimoku Cloud has several components. The Tenkan-Sen line represents the midpoint of the previous nine candlesticks. The Lagging Span is a moving average of the past 26 periods. It is a directional indicator, and it can be used for both support and resistance. In a ranging market, the Ichimoku Cloud is not a reliable tool. As with any other technical indicator, you must be able to interpret the context of a particular technical chart.